Looking back to the beginning of the year, you, like many automotive dealers, seriously contemplated a new people strategy as a way to lower the cost of sales. You considered breaking down role silos within the dealership as a way of enabling customers to develop trust with a primary point of contact. You also wondered about how to create better opportunities for your employees—both in compensation and quality of life. You had the best intentions, but your dealership got busy. Business was on a roll and disrupting that through a major reorganization would slow things down.

Then COVID-19 hit, and suddenly the world became a different place. You may have had to let people go. Like other dealers, you may have applied for an SBA Paycheck Protection Program loan and are now considering how to take advantage of the forgiveness provision. As a result, it’s time to realign the single greatest investment you have—your people—and derive the most value from this resource. And auto dealerships like yours are not alone—the majority of small businesses are considering changing workforce profiles post-COVID.

The time is right for radical changes. Crane Automotive Resources founder Candice Crane offers practical advice for dealers desiring to emerge with stronger people strategies post-pandemic. Her approach consists of two key elements: redesigning roles and restructuring compensation.

Redesigning Roles

More than likely, most dealerships won’t be bringing everyone back into the workforce once the pandemic is over. The smartest dealers will rehire individuals with the broadest scope of expertise and then cross-train them in sales and F&I processes, as well as dealership technology tools. Ultimately, this will improve and streamline the customer experience. Buyers will have a single point of contact instead of going through multiple people to purchase a car, service a vehicle, or evaluate a trade-in. The added plus is that this approach will significantly reduce the cost of sales.

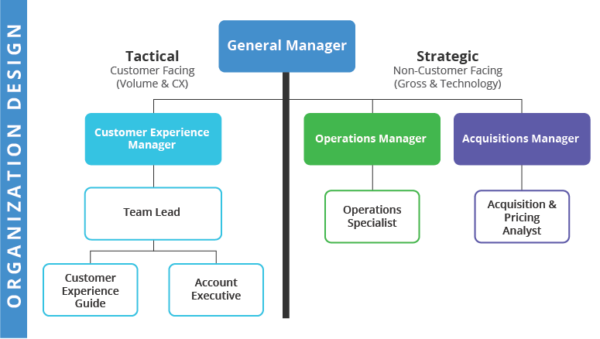

Crane proposes a new organizational structure where dealerships are divided in two teams: a tactical team focused on both sales volume and the customer experience and a strategic team focused on overall business growth and technology.

On the tactical side, the Customer Experience Manager oversees a team that handles customer activities. The Team Lead manages Customer Experience Guides (salaried hands-on, customer service-oriented individuals) and Account Executives (professional salespeople who work on a combined salary and commission/bonus plan).

On the strategic side, the Operations Manager and Operations Specialist don’t interact with customers. Instead, they manage relationships with banks to ensure that contracts are properly and fully executed. The Acquisition and Pricing Manager works with the Acquisition and Pricing Analyst on the invoicing and pricing of every vehicle on the lot.

The beauty of this structure is that everyone gets to do what they do best. It also has built-in fluidity, so anyone in any given position can move laterally or up the ladder as needed.

Restructuring Compensation

Increasingly, dealerships are recognizing what’s truly valuable to their employees—things like quality of life and a stable income—and are redesigning compensation plans.

As Crane points out, “Compensation should never be a surprise. Now is the time to look at your compensation plan in a way that makes more sense for your employees, your customers, and your business.”

More dealerships are moving toward a base pay (an hourly or monthly guarantee) plus commission/bonus model. Instead of aggressively and single-mindedly pushing for sales, stores are requiring employees to make a certain number of customer outreach calls every day. These are not traditional sales calls, but a chance to connect with customers on a personal basis. This opportunity creates a culture of collaboration, whereby team members share customer insights with each other and work together to structure deals, increase revenue, and improve the overarching customer experience.

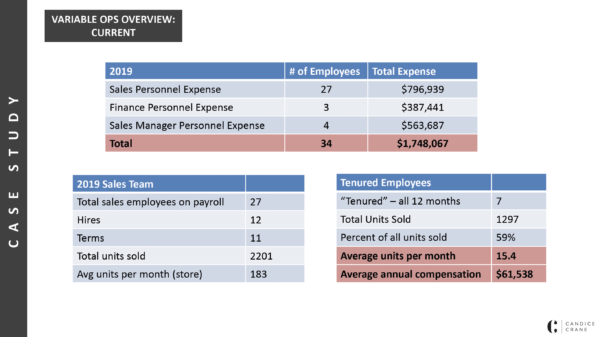

In a 2019 case study, shared by Crane on AutoFi’s webinar, one dealership spent $1.75 million for 34 employees. On the sales side of the organization alone, there were 27 people on the payroll (with 12 new hires and 11 terminations). Over the course of a year, those salespeople sold 2,201 cars, amounting to about 183 per month. However, only seven people were there for the entire year, selling 1,297 cars (59% of sales). Top producers averaged approximately $60,000 per year in earnings.

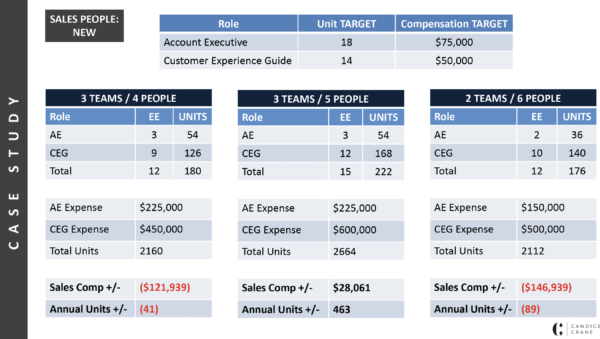

Crane suggested a complete overhaul of the sales compensation structure, illustrated below. In this model, account executives were actually compensated more—to the tune of $75,000 on average—based on a salary plus individual bonuses, team bonus, and accelerators.

Even with higher account executive compensation, dealerships could realize a labor cost per unit savings of $120, $190, or $164, depending on the number of teams and the amount of people per team.

What are the takeaways?

In risk-averse times, it’s important to make it attractive for existing employees to remain at your dealership, and for new hires to want to join your store. And be open to embracing efficiency when it comes to managing the customer experience to make it less complicated, seamless, and more enjoyable.

View the People Strategies for Remote Selling webinar on demand, and join us for the AutoFi Remote Selling & Social Distancing Series, every Tuesday, 9:00 AM Pacific through May 12, 2020.

Find out how AutoFi can help your business thrive.

* Caveat: As always, I urge you to check with your local and state Dealers Association to ensure you are operating within current guidelines.